New Approach for Loan Requests

Maddening? Maybe, But...

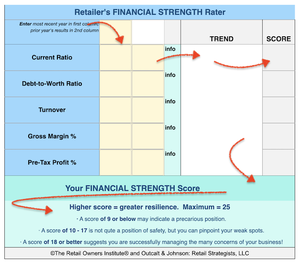

In today's financial climate, how in the world can independent retailers (that's the 92% that are not publicly traded) get financing?

In most cases banks are not lending (even as they run ads proclaiming their "support for small businesses.") Landlords aren't more lenient, nor are many vendors. Even mothers-in-law are asking tougher questions!

So, what should a retail owner do? Just give up on the idea of getting financing? Or, worse, accept the cash offers from vendors, payment processors, or POS providers who take their "payments" right off the top of your daily sales?

Well, it is maddening, but The ROI recommends an easy exercise that may be of great help.

Maddening? Maybe, But...

In today's financial climate, how in the world can independent retailers (that's the 92% that are not publicly traded) get financing?

In most cases banks are not lending (even as they run ads proclaiming their "support for small businesses.") Landlords aren't more lenient, nor are many vendors. Even mothers-in-law are asking tougher questions!

So, what should a retail owner do? Just give up on the idea of getting financing? Or, worse, accept the cash offers from vendors, payment processors, or POS providers who take their "payments" right off the top of your daily sales?

Well, it is maddening, but The ROI recommends an easy exercise that may be of great help.