Isn't it great? Headlines and the media world seem to be in unison; the dastardly COVID pandemic is being arrested. And, if we can believe the pundits, pent-up shoppers are about to buy all sorts of products and services with abandon.

But, will they?

Given this exuberance, many retailers could be building up excess inventory. Retailers once again need to be true merchants. That is, the #1 responsibility of retail senior managements must always be to control inventory. (It's the only thing that makes money, but it soaks up cash.)

But, will they?

Given this exuberance, many retailers could be building up excess inventory. Retailers once again need to be true merchants. That is, the #1 responsibility of retail senior managements must always be to control inventory. (It's the only thing that makes money, but it soaks up cash.)

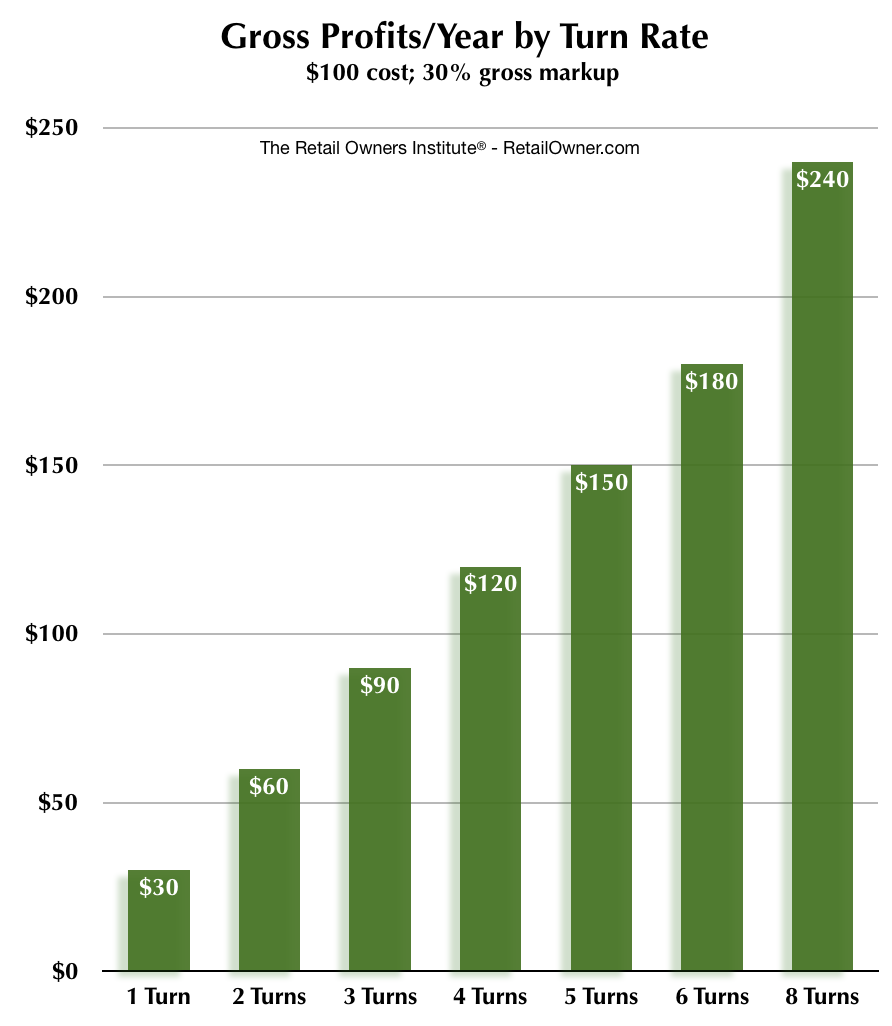

Here's a refresher course for all. For each $100 of inventory @cost, as it sells, its markup (margin dollars) helps cover expenses and adds to gross profit.

Even a modest increase in inventory turnover rates per year can yield a dramatic increase in margin dollars and thereby net profits. (For the formula for turnover and more perspective, see the section at The ROI focused on Inventory Control.)

Look again at that chart above. See how turnover is dramatically related to your gross profits?!

When turnover is properly focused on, it produces more sales by keeping a fresh flow of new merchandise coming into your store. As well as increasing margin dollars.

Maximizing turnover reduces markdowns.

Improvements in payroll, rent markups, and freight are controlled by competitive or fixed expenses. But turnover is directly within your control! And should never be neglected.

All of which helps explain why Michael Gould, when Chairman of Bloomingdales, so famously exclaimed to his buyers:

"No retailer ever went bankrupt because their turns were too high!"

The ROI is wondering: Might you be caught up in the exuberance of the post-pandemic hype? It's okay, as long as you're also focusing enough attention on your inventory turnover. (Yes, we believe in tough love.)

Even a modest increase in inventory turnover rates per year can yield a dramatic increase in margin dollars and thereby net profits. (For the formula for turnover and more perspective, see the section at The ROI focused on Inventory Control.)

Look again at that chart above. See how turnover is dramatically related to your gross profits?!

When turnover is properly focused on, it produces more sales by keeping a fresh flow of new merchandise coming into your store. As well as increasing margin dollars.

Maximizing turnover reduces markdowns.

- When turnover is too slow, the results are excessive markdowns – poor cash flow – higher operating expenses – and even lost sales!

- Inventory and sales determine turnover.

Improvements in payroll, rent markups, and freight are controlled by competitive or fixed expenses. But turnover is directly within your control! And should never be neglected.

All of which helps explain why Michael Gould, when Chairman of Bloomingdales, so famously exclaimed to his buyers:

"No retailer ever went bankrupt because their turns were too high!"

The ROI is wondering: Might you be caught up in the exuberance of the post-pandemic hype? It's okay, as long as you're also focusing enough attention on your inventory turnover. (Yes, we believe in tough love.)